The Definitive Guide to Traditional

Wiki Article

What Does Roth Iras Do?

Table of ContentsNot known Details About 529 Plans

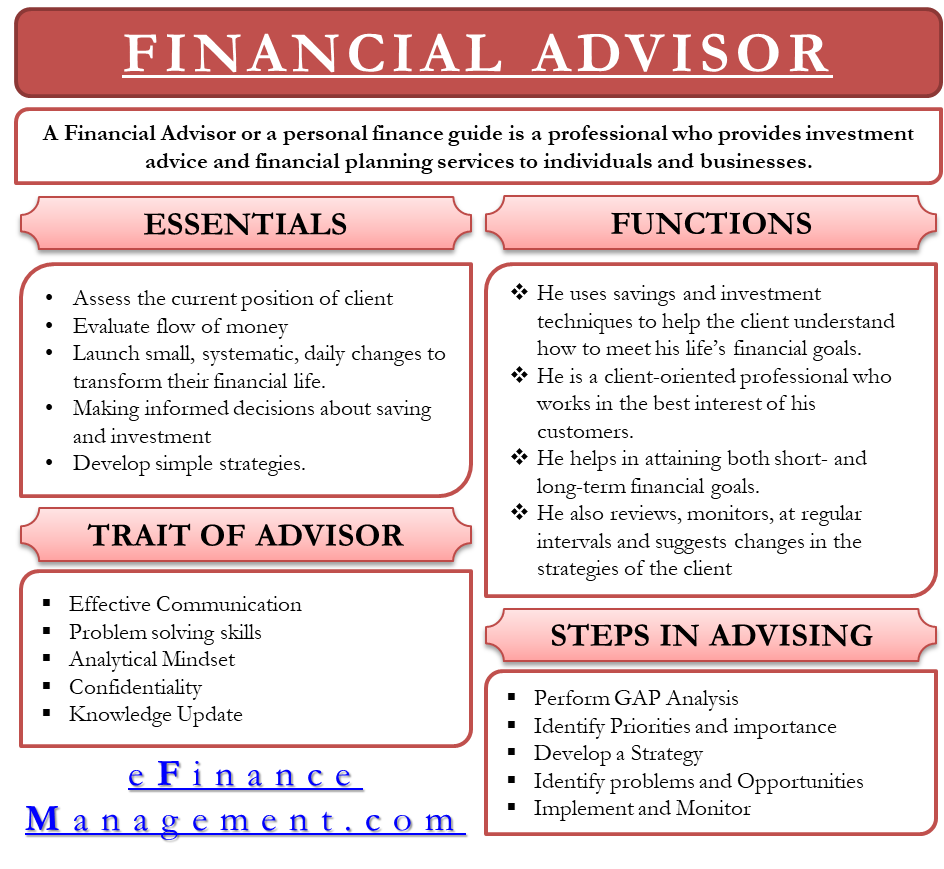

Financial expert's pay can be based on a fee, payment, profit-percentage framework, or a combination thereof. "Financial advisor" is a generic term without precise sector interpretation. Therefore, this title can define lots of different kinds of economic experts. Stockbrokers, insurance policy agents, tax obligation preparers, investment supervisors, as well as financial organizers can all be considered monetary advisors. Still, an important difference can be made: that is, an economic expert has to in fact supply advice and advice. An economic consultant can be distinguished from an implementation financier that just places professions for clients or a tax accounting professional who just prepares tax returns without supplying advice on just how to take full advantage of tax obligation benefits . A true economic consultant should be a well-read, credentialed, experienced, monetary expert who services part of their customers, as opposed to offering the interests of a banks by optimizing the sales of certain products or utilizing on commissions from sales. There were 330,300 professional financial consultants in the U. Traditional.S. Nevertheless, their settlement structure is such that they are bound by the contracts of the business where they function.

Because the enactment of the Financial investment Advisor Act of 1940, 2 kinds of connections have actually existed between economic intermediaries and also their clients. These are the reasonableness standard and also the more stringent fiduciary criterion. There is a fiduciary relationship that calls for advisors signed up with the Securities and also Exchange Commission(SEC)as Registered InvestmentAdvisors to work out tasks of loyalty, care, and also full disclosure in their communications with clients. While the previous is based upon the concept of "caution emptor"directed by self-governed regulations of"suitability "and also"reasonableness"in recommending a financial investment product or approach, the last is based in government legislations that impose the highest possible moral criteria. The economic planner is one certain type of monetary expert who concentrates on helping companies as well as individuals develop a program to fulfill long-term monetary objectives. An economic planner may have a specialized in investments, taxes, retired life, and/or estate preparation. Even more, the financial organizer may hold different licenses or designations, such as the Certified Financial Coordinator(CFP)classification. To end up being an economic advisor, one initial demands to finish a bachelor's degree. A level in finance or business economics fee based advisor is not required, however this does help. From there, you would seem hired by a financial organization, most typically signing up with through an internship. It is advised to operate fiduciary financial advisor at an institution as it will sponsor you for the industry licenses you require to finish before being able to exercise as an economic expert. A teaching fellowship or entry-level task will certainly additionally aid you understand the market as well as what is needed for the profession. 401(k) Rollovers. The licenses you will need to finish might include Collection 7, Series 63, Collection 65, and also Collection 6. As soon as you acquire the licenses, you can work as an economic advisor. Financial experts are tasked with taking care of every element of your monetary life, from retirement preparation to estate preparation to cost savings as well as investing. They analyze your financial condition and understand your economic goals and also develop a tailored financial strategy to achieve those goals. They can help in reducing the tax obligations you pay and maximizethe returns on any kind of monetary assets you might own. The price of a monetary expert depends upon the services you employ them for. There are likewise different charges for the various tasks that an economic expert will certainly execute. Several financial consultants charge a flat annual cost between$ 2,000 and $7,500; between$1,000 and also $3,000 for producing a tailored economic strategyand relying on the agreement, compensations of 3%to 6%on view the account.

Report this wiki page